Head-to-head: Amazon Web Services vs Google Cloud Platform

Both behemoths in their own way, but which one owns the UK cloud space?

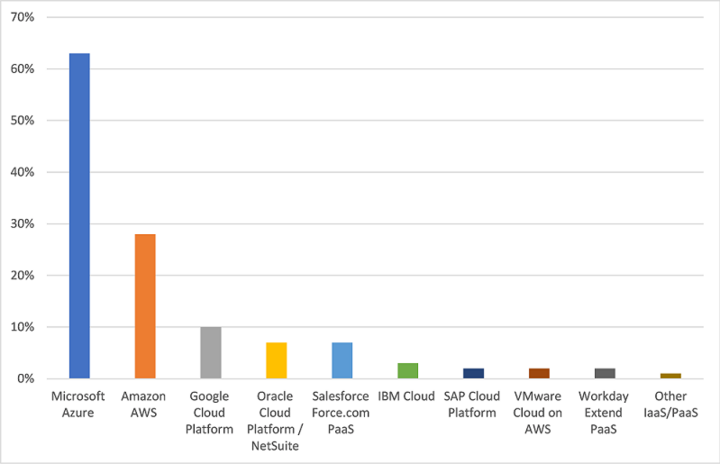

The market for cloud infrastructure - meaning platform- and infrastructure as a service (PaaS and IaaS) - is defined globally by Amazon Web Services, Microsoft Azure and Google Cloud Platform. Nearly every company in the world with a cloud presence, from those with 10 employees to those with 10,000 or more, uses one of the cloud giants in some capacity. But there are regional variations: in the UK, Azure is the front-runner, leaving AWS and Google to pick up behind it.

Of course, there is some competition: other tech vendors like Oracle, SAP and Salesforce have their own clouds, and China's Alibaba, as well as some European providers like France's OVHCloud, provide at least some contest to the Americans. But really, it is AWS, Azure and GCP that rule the world stage.

Globally, AWS takes about a 34 per cent market share. However, the UK has historically shown a preference for Azure and that hasn't changed in this year's analysis: AWS is in second place, with Google following in a distant third. But that doesn't mean the search giant has nothing to offer.

Each year, Computing Delta checks the take-up and opinions of IT leaders on public cloud providers, through a mix of online surveys and interviews. Here we present our comparison of AWS and Google Cloud Platform from research undertaken in December and January, amongst more than 180 senior IT professionals in the UK.

What's the difference between AWS and Google Cloud Platform?

- Approach: Both AWS and Google offers robust IaaS and PaaS features. They focus on expansion over integration, but AWS has an extensive partner ecosystem, while Google is still building its own.

- Services: AWS has the largest range, with close to 100 different services, but both companies offer a wide selection of features including compute, networking, security and storage.

- Pricing: Cloud pricing is extremely complex and dependent on the services used, but respondents mostly felt that Google's pricing was more competitive than AWS'. Both are pay-as-you-go, but AWS charges per hour while GCP is more granular and charges by the minute.

- Adoption: AWS is the second most popular cloud platform in the UK: 47 per cent of respondents trialled it and 28 per cent took it to production. By comparison, only 17 per cent trialled Google and 10 per cent took it to production.

AWS vs Google Cloud Platform: the background

AWS has long been the most popular cloud platform worldwide, but UK users have historically favoured Azure. However, Google is a relatively new competitor on the scene - launching its IaaS/PaaS offering in the mid-2010s - and has attracted a small but growing number of devotees.

One caveat to note is that a significant proportion of respondents, about 37 per cent, came from firms with 2,500+ employees, which tend to favour AWS and Azure: only two per cent of large and enterprise-scale firms in our research were using Google Cloud Platform.

Clearly, AWS is in front when it comes to following through from trial to a production environment. It can't offer the same integrations with enterprise software that Microsoft can, but then again, neither can Google.

What AWS does provide is extensive geographical coverage, 200-plus services and high configurability - provided you can work your way around the ecosystem. "It offers a wide range of services covering extensive regions; very powerful, mature and extensible," said a development manager at a software company.

Other IT leaders in our survey said:

- "Massive provider, great support, great regional availability."

- "Class leader in configurability."

- "Wide range of services covering extensive regions; very powerful, mature and extensible."

- "Perhaps most mature platform, trusted by many developers, great for open source."

Maybe not enterprise ready

Unlike AWS, Google does have its own SaaS offering (Workspace, formerly G-Suite) that GCP integrates with, but it is much less popular among businesses than Office 365, so not a compelling reason on its own to use Google Cloud.

The company was also much slower to enter the public cloud space than its competitors. While AWS was arguably the first to market in 2002, Google didn't arrive until 2008. Although both have now been available for more than a decade, Google is struggling to break the preference that crystallised around AWS. It is still seen as more of a consumer product than an enterprise one today; one respondent noted that although GCP has "good data and analytics capability" it is "maybe not enterprise ready."

What Google does offer is great analytics capability and comparatively lower prices versus its competitors, as well as a more user-friendly experience overall. Its service offerings may be narrower, but what it does, it does well. For example, GCP has strong support for containers and Kubernetes deployments, plus a smoother learning curve than its rivals.

A manager in a small tech firm felt Google was "not as familiar a name in this space as Microsoft and Amazon, but a reliable and scalable alternative to both." Another user, a systems architect in a large leisure sector business, said GCP had "strong Kubernetes and data platform offerings."

Other respondents said:

- "Massive provider with great support, but retraining required."

- "Provides access and integration to many other useful Google services."

- "Strong Kubernetes and data platform offerings, more coherent set of services/integrations than AWS, but not as broad a service."

- "Solid technology and well-priced."

AWS vs Google Cloud Platform: at a glance

AWS vs Google Cloud Platform: global reach

All the big cloud providers define infrastructure metrics such as availability zones and geographic regions differently, so direct comparisons are not particularly helpful. Both AWS and GCP are available in many parts of the industrialised world.

AWS has six availability zones (separate data centres within the same latency region) in Europe, with two more on the way. Google has seven, with plans to add five more in Paris, Milan, Madrid, Turin and Berlin.

AWS vs Google Cloud Platform: pricing

It is very difficult to directly compare the price of large cloud vendors' services. Their pricing permutations and combinations are carefully optimised to maximise profits while keeping customers on the right side of walking away, and are full of loss leaders, special deals, opaque terms and hidden extras. In addition to this, they often use different names for similar products. Here we are focusing on virtual machines, which are slightly easier to compare than other elements.

AWS EC2 instances start at £0.038/hour for the t4gnano with 0.5 GiB RAM and 2 vCPUs, rising to £21.97 for a p3.16xlarge with 488 GiB RAM, 64 vCPUs and 25 Gigabit bandwidth.

Google brands all of its virtual machines ‘Compute Engine' and features a huge variety, from general purpose to those optimised for memory, compute, accelerator and more. Although it has standard offerings with between two and 32 virtual CPUs, custom machines are also available. Pricing for a general purpose VM, with 2 vCPUs and 8 GB memory, is £0.063/hour, while a more robust 32 vCPU VM with 128 GB memory would be £0.79/hour. Savings are available through the on-demand and committed use pricing options. Google also offers a 'spot price' option; these are dynamic and can change every 30 days, but offer a 60-91 per cent saving over the on-demand price.

There is, of course, a huge amount of granularity in pricing and both firms have various deals and discounts available: for example, AWS will slash its prices for reserved instances (RIs) by up to 75 per cent, and even exchange them for other services.

Customers should also remain aware of hidden extras that cloud vendors like to tack on, such as egress costs. AWS customers said, "Expensive, and not easy to move away to another provider," and while one said, "Pricing policy is good, [and AWS is] actively advising on suitable pricing options to customers," the company has "a reputation for complexity."

Google Cloud customers were much less concerned with high prices; in fact, respondents called it "cheap and cheerful" and "well-priced," though noted the relative lack of maturity versus its competitors.

Egress

The increasing popularity of the multi-cloud model has formed a battleground around egress costs: the fees charged when moving data out of the cloud. These fees can generally be minimised by keeping data transfers within the same region (Europe, for example), but they remain a substantial hidden cost of doing business in the cloud.

In the past AWS has been accused of levying high prices for removing data from its ecosystem, but last year it bowed to the inevitable and extended its free tier before egress charges kick in. For many smaller users there is now less separating the major cloud providers on basic data transfer costs, although AWS's bandwidth pricing in particular is complex to navigate.

We heard more complaints about AWS's egress charges than GCP's, although those impressions may date from before the free tier extension.

* Google recently announced new prices for its cloud infrastructure come October, with some products rising and some falling in cost. This includes a big change to data egress charges, though Google claims it is simply bringing its prices in line with competitors.

Although cents per GB sounds inexpensive, the amount of data the average business moves around means these costs add up quickly, and vendors with transparent prices in this area are rewarded with business. Nobody likes to be stung on what they thought was a good deal.

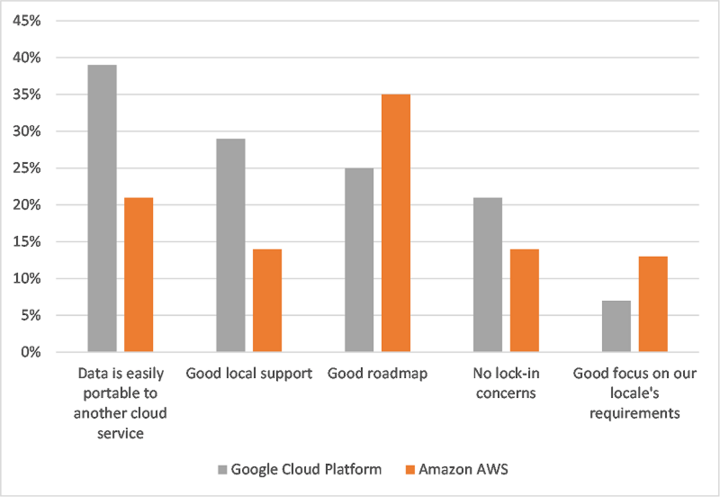

There was practically no difference between AWS' and Google's scores in this area in our survey: 13 per cent of AWS customers said data egress was inexpensive, versus 14 per cent of GCP customers. However, when it came to the ease of data transfer Google scored much higher: 39 per cent of users said their data was easily portable to another cloud service, versus just 21 per cent of AWS users. Similarly, 21 per cent of Google customers had no lock-in concerns; that sounds low, until you realise that that metric was just 14 per cent among AWS users.

Free tier

Free tiers are how cloud vendors bring in individuals and small-time users, in the hope they will become big-time paying users. Some free services are perpetual, others are limited to a year and restricted in their terms of use. Both AWS and Google offer respectable free tiers; AWS' is more extensive, but Google's is not limited on time.

AWS's Free Tier includes 750 hours of Linux and Windows EC2 t2.micro or t3.micro instances each month for one year. To stay within the free tier, users must only deploy EC2 micro instances. Other freebies include 5 GiB of S3 cloud storage, 25 GiB storage in Amazon DynamoDB, 1 million requests to Lambda serverless functions, and more - up to 100 packages, in fact.

Unlike AWS' offering, the Google Cloud Platform Free Programme has no time limit. The major offer is the GCP Free Tier, which includes more than 25 free services, subject to monthly usage limits (usage above these limits is billed at the standard rate). For example, users will be able to use a free E2-micro (2 vCPUs, 1 GB memory) instance in the US up to 'the number of hours in the current month', which could be anywhere from 672 to 744. Google also offers a 90-day free trial of Google Cloud and Google Maps platform, which includes $300 in Cloud Billing Credits.

AWS vs Google Cloud Platform: Support

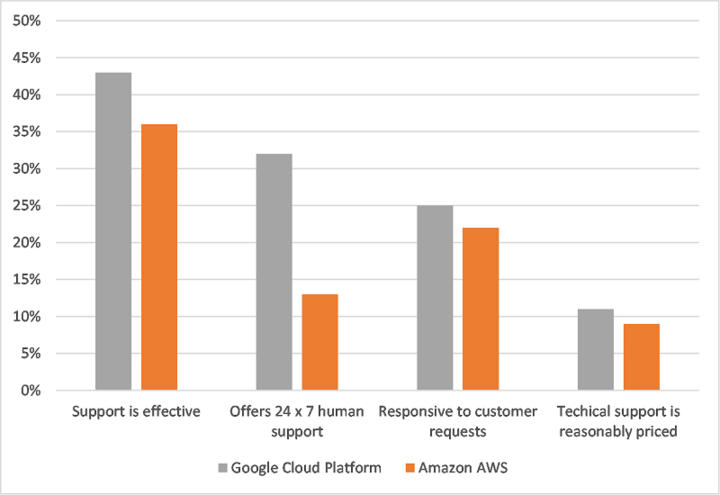

In general, cloud giants like AWS and GCP rely on their partners like MSPs and resellers for customer interactions. We have judged the companies based on both these experiences and the rare direct correspondence. Although neither performed particularly well, Google took the support crown, especially in the areas of local support and 24x7 human support: the latter probably due to cost.

That said, users had some praise for both Google and AWS, which is a change from past editions of this research. Customers mentioned both vendors' "great" support, and specifically picked out AWS for its "Regular[ly] updated support."

Both companies' paid support plans start at $29/month, scaling up to $15,000/month for AWS or $12,500/month for GCP. AWS is notable in that the dollar price is simply a base level; customers could pay that or 3-10 per cent of monthly AWS charges, whichever is greater. Google also includes a percentage of monthly charges on its support plans (three per cent, or four per cent for the top-level Premium Support), which are in addition to the dollar price rather than replacing it.

Understandably, neither vendor scored well for the price of their tech support.

Which of the following terms describe your experience with your cloud provider?

Which of the following terms describe your experience with your IaaS/PaaS?

AWS vs Google Cloud Platform: Complexity

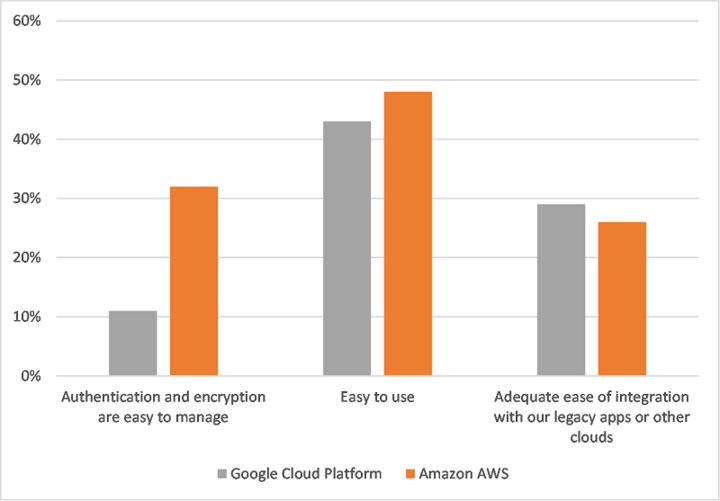

Both platforms are complex to use and manage; fewer than half of either vendors' customers said AWS or GCP were easy to use.

AWS has many more services than Google, but is more complex to set up; and neither are easy to integrate with legacy or on-premise systems (although GCP, of course, has excellent integrations with Google's own services).

Complexity is an important issue, because it means that mastering the services requires skills and experience. When similar services have different names and different ways of working between platforms, this is another way that organisations can find themselves locked in. Cross-cloud skills are rare and expensive.

AWS

- "Early platform so got a head start; reliable and scalable; costs mostly reasonable; setup is complex."

- "Pros: Cheap, Big, Easy to access. Con: Not that easy for a new user to understand."

- "Expensive and complicated."

- "Reliable and massive scale but too many offerings to be clear on what provided best value."

- "AWS can be cheaper, but it's often much harder to use and manage."

GCP

- "More coherent set of services/integrations than AWS, [but] not as broad a service."

- "Very easy to get started with and not as bewildering as AWS on first acquittance. New products being added all the time and documentation and support we get is great."

- "Provides access and integration to many other useful Google services."

- "Difficult transition away from the platform to another provider."

- "Less integration with on-prem systems. Would be preferred only after AWS and Azure."

AWS vs Google Cloud Platform: Roadmap

Both AWS and GCP are constantly introducing new services, but that can and has backfired on several occasions. Customers find it difficult to follow AWS' frequent update schedule, and although its roadmap was seen as clearer than Google's, only about a third of users who felt that way. On the other hand, GCP introduces fewer services, but ongoing support is lacking: there is a feeling that if a new service isn't successful quickly, Google will simply abandon it. Customers said, "I'd be worried that Google will drop support for their products," and that they were "worried about longevity of the product."

Many of the recent announcements on the AWS 'what's new' page concern the Elastic Kubernetes Service (EKS), showing that cloud native is an area of focus. Some respondents felt that AWS was a little behind others, particularly Google, on AI/ML; its last announcement in this area was in 2020. At AWS Reinvent in December the company talked about private 5G, sustainability goals, Control Tower to manage regions, IP address manager, EBS snapshots to reduce storage costs, and Kinesis data streams on demand.

Google pays close attention to public perceptions, and several of its most recent announcements focus on sustainability initiatives like Active Assist (although the company was still only middle-of-the-road at best on its green practices in our recent research - keep an eye on Computing for an in-depth examination for how each major cloud provider does in this area, coming soon). However, some respondents actually cited perception issues as a strike against Google, specifically relating to data privacy and trustworthiness.

Google's next cloud event will be in April 2022, where the firm will discuss its data analytics roadmap.

Conclusion

Despite a large gap in adoption both globally and in the UK, AWS and GCP have more similarities than differences. They share a relentless focus on expansion without much in the way of integrations, at least when it comes to external services, and share similar scores on areas like support, complexity and ease of use. On a more negative note, both firms have poor and worsening public perception.

Historically, developers have chosen AWS, and it may still be best for many open-source and cloud-native projects; although licensing rows may have tarnished its image somewhat, as have news stories about antitrust, downtime, treatment of workers and the antics of its CEO - all of which were mentioned by our respondents. It has also been famed for innovation, but signs are the other clouds may have caught up here, especially around AI.

AWS users praised its scalability, range of offerings and availability. It was generally thought to be reasonably priced, and the support is fine, so long as you are willing to pay for it. Among many of our respondents it was still the go-to cloud, but maybe not the only one anymore.

Google is seen as an innovative platform, with reasonable prices and a lower barrier to entry than AWS. Support was praised and it has notable strengths, particularly when it comes to containers, microservices and data analytics. Users also welcomed GCP as competition for other hyperscale cloud providers. However, media reports about antitrust practices and data privacy issues have somewhat spoiled Google's public perception.

You may also like

/news/4337271/cloud-big-sign-open-letter-urging-datacentre-kit-suppliers-step

Green

Cloud big three sign open letter urging datacentre kit suppliers to step up

Embodied carbon emissions are the focus

/news/4332004/microsoft-cuts-jobs-settles-lawsuit

Corporate

Microsoft cuts more jobs, settles lawsuit

The company acknowledged 'organisational and workforce adjustments' as a standard practice

/news/4327230/microsoft-quietly-shelved-underwater-datacentre-project

Cloud and Infrastructure

Microsoft quietly shelved underwater datacentre project

Lessons have been learned from Project Natick, says Microsoft’s Noelle Walsh